The post-pandemic world will see much returned to normal, but there will also be change. For businesses that faced shutdowns, these changes will include higher taxes to pay for the costs of mitigating the economic impact, and the loss of tax revenue. In addition to imposing higher tax rates, some governments will strive to raise revenue by accelerating their adoption of digital technologies to enhance compliance. Taxes are the largest single expenditure for most corporations, both taxes on...

Read More

Topics:

Office of Finance,

Financial Performance Management,

ERP and Continuous Accounting,

Revenue,

robotic finance

BlackLine recently held its first virtual user conference, Beyond the Black, where it detailed numerous additions and enhancements to its applications. Of note was the launch of BlackLine Cash Application, an accounts receivable (AR) processing software based on software originally developed by recently acquired Rimilia. The new application fits the company's product strategy of providing accounting departments with software that automates time-consuming repetitive tasks and substantially...

Read More

Topics:

Office of Finance,

Business Planning,

Financial Performance Management,

ERP and Continuous Accounting,

AI and Machine Learning

In the context of planning, budgeting and benchmarking, external data includes information about the world outside an organization such as economic and market statistics, competitors and customers. Today, a comprehensive set of external data is a “nice to have” item in most organizations, but that’s likely to change. External data is necessary for useful and accurate business-focused planning and budgeting, and for performance benchmarking. It is also essential for the effective applications of...

Read More

Topics:

Information Management,

Business Planning,

Financial Performance Management,

Predictive Planning,

AI and Machine Learning

Can you imagine a more arcane and boring topic than accounts receivable? Unless you are the CFO, controller, chief accounting officer or treasurer of an organization, maybe not. Anecdotally, as it’s part of the trend to the digital transformation of all things in the department, there appears to be greater interest in this area of the Office of Finance. With populations locked down and the accounting staff unable to work in an office, the need to operate virtually has accelerated the...

Read More

Topics:

Office of Finance,

Financial Performance Management,

ERP and Continuous Accounting,

robotic finance,

AI and Machine Learning

One of the oddities of corporate management is that, as a rule, nobody oversees managing profitability. CEOs are accountable for meeting company-wide financial targets and assign responsibility for achieving profitability levels to business unit owners across and down an organization. Sales quotas designed to achieve revenue goals are put in place, and budget owners have cost and margin objectives. But setting profitability objectives is not the same as managing profitability.

Read More

Topics:

Office of Finance,

Sales Performance Management (SPM),

Financial Performance Management,

Price and Revenue Management,

Digital Commerce,

Predictive Planning,

Subscription Management

In preparing this research note I took the precaution of searching “value-based planning” to see what came up. Over the years, the term has been used in several contexts each with different shadings. By my definition it’s an approach to planning and budgeting that maximizes the long-term value of an organization by considering all its objectives – not just the financial targets. Value-based planning is a more effective management tool for executives because it defines objectives in terms of...

Read More

Topics:

Office of Finance,

Financial Performance Management,

Predictive Planning

Enterprise resource planning (ERP) systems are central to nearly every organization’s management of operational and financial business processes. They are essential to the smooth functioning of an organization’s record keeping, accounting and finance tasks. In manufacturing and distribution, ERP manages inventory and logistics. Some ERP software vendors incorporate an extended set of capabilities that include managing human resources as well as supply chains and logistics. In the 2020s,...

Read More

Topics:

Office of Finance,

Financial Performance Management,

ERP and Continuous Accounting,

robotic finance,

Predictive Planning,

AI and Machine Learning

A couple of years ago, I started talking about a “New Era of Trade.” Its starting point was the world financial crisis in 2007, but the evidence that we were experiencing a shift only became obvious years later. I think “new era” is a better description of what’s going on than calling these bilateral ructions a “trade war.” I avoid that latter term because I believe it should apply to an environment that truly merits such a description, one similar to the period from the late 1920s and well...

Read More

Topics:

Office of Finance,

Operations & Supply Chain,

Predictive Planning,

continuous supply chain

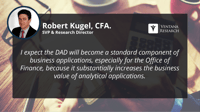

An important recent development in software designed for the Office of Finance is the addition of what we’re calling a data aggregation device (DAD) for analytical applications. A DAD automates the collection of data from disparate sources using, for example, application programming interfaces (APIs) and robotic process automation (RPA). With a DAD, users of the analytical application have immediate access to a much broader data set; one that incorporates operational as well as financial data...

Read More

Topics:

Office of Finance,

Analytics,

Business Intelligence,

Data,

Financial Performance Management,

Price and Revenue Management,

robotic finance,

Predictive Planning,

AI and Machine Learning

In this Analyst Perspective from Robert Kugel, learn how FP&A can redefine its mission to achieve the long-stated goal of making it more of a strategic partner with the rest of the organization. This means fully adopting integrated business planning, a high participation, collaborative, action-oriented approach to planning and budgeting built on frequent, short planning sprints. Short planning cycles enable companies to achieve greater agility in responding to market or competitive changes, and...

Read More

Topics:

FP&A,

Office of Finance,

Budgeting,

Business Planning,

CFO,

financial planning,

forecasting

.png?width=200&name=Profit_Management%20(1).png)